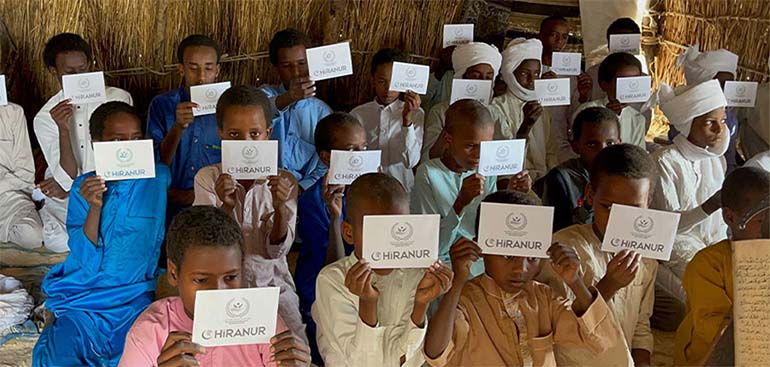

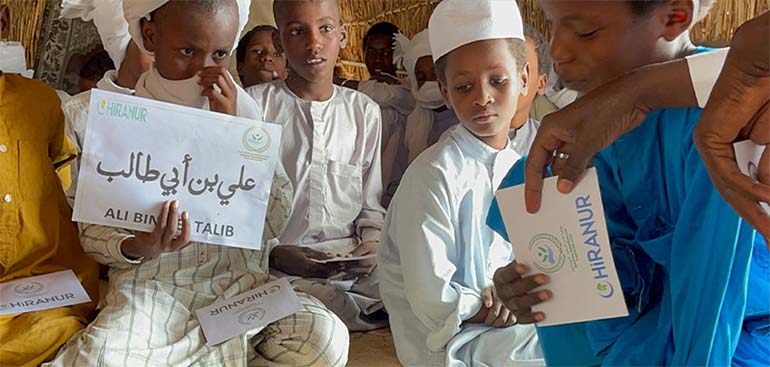

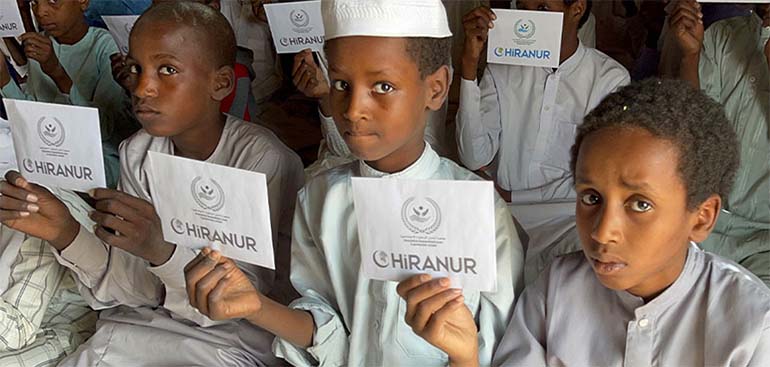

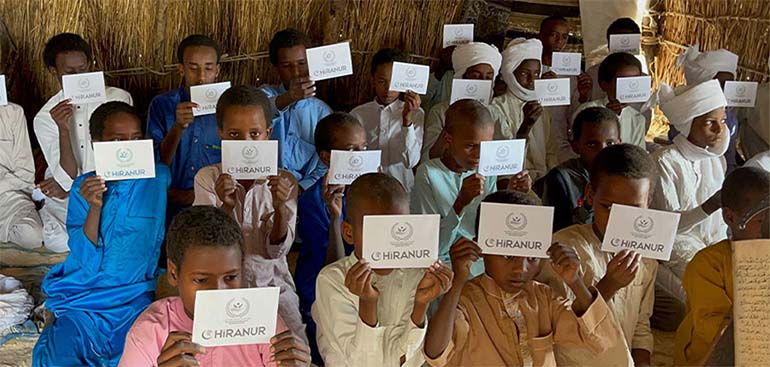

As Hiranur Ilm and Service Association, we carefully identify real beneficiaries in need both domestically and abroad to deliver the entrusted zakat, fitrah, and fidyah funds of our benevolent donors and to convert their helplessness into hope and their sorrow into happiness, and to show that we are with them in their difficult struggles.

Africa is one of the continents where aid activities are most common. As Hiranur Association, we provide aid with your donations in Asian countries such as Bangladesh, Arakan, Syria, Palestine, and Yemen, where many poor countries are located, but many more brothers and sisters in need of help are still waiting. Hiranur Association has undertaken the task of being a bridge that enables these oppressed people to receive help from benevolent people. Although many aids are sent through governments, organizations, and individuals, Hiranur Association is among the pioneers of organizations delivering aid.

With various types of aid, we strive to meet the hunger, thirst, and other needs of people in Africa, Syria, Yemen, and Palestine. Therefore, as Hiranur Association, we fight to extend a helping hand to people in need anywhere in the world, to never sleep full while someone else is hungry, to share the blessings at hand for the unity and solidarity of humanity, and to build bridges of the heart disregarding distances.

Poverty is a reality that exists all over the world, but in Africa and some regions, it has taken such a form that people have to complete their days without even having a proper meal. People struggle to live, and they are waiting for a helping hand to reach out to survive.

Click on the Relevant Buttons to Support Our Projects.

What is Zakaat?

Zakaat is the annual amount that a person who owns a certain amount of property should give to the poor.

Why is Zakaat important?

In the Quran, prayer and zakaat are mentioned together in many places. It is stated that Allah curses those who do not give zakaat. They will face famine, their property will be contaminated, and it will be destroyed. ("Establish prayer and give zakat. And bow with those who bow [in worship and obedience]."(Surah al-Baqarah 2:43))

What is Fitrah?

Fitrah, originally called fıtrah charity, is the charity that wealthy individuals who have completed the fast of Ramadan must give to the poor in the month of Ramadan as a gratitude for reaching it. The amount of fitrah is determined based on one person's daily food and drink needs.

What is Fidyah?

Fidyah refers to the amount that a person who cannot fast during the month of Ramadan or commits errors during the Hajj pilgrimage must give to the poor in order to compensate for their deficiencies in these acts of worship.

Since our religion commands sharing and mutual assistance, you can support our Muslim brothers and sisters who are trying to fulfill their religious obligations while experiencing hunger by making donations to our association. As an association working with the awareness of "One who sleeps with a full stomach while his neighbor is hungry is not one of us," our support and assistance to the hungry and poor people always continue, both domestically and in Asia (Bangladesh, Arakan, Syria, Palestine, Yemen, Afghanistan) and Africa, where we deliver the zakat donations entrusted to us.

We deliver the zakat donations entrusted to us to the real beneficiaries in need both domestically and in Asia (Bangladesh, Arakan, Syria, Palestine, Yemen, Afghanistan) and Africa.

Click on the relevant buttons to support our projects.

Sıkça Sorulan Sorular

The people who will receive Zakaat are specified in the Quran. These are; the poor, the needy, the officials responsible for collecting Zakaat, those whose hearts are to be reconciled to Islam (new converts), those in bondage (slaves and captives), those in debt, those fighting for the cause of Allah (jihad), and those stranded on a journey (Tevbe, 9/60). A poor and needy person is someone who does not have the nisab amount of wealth, except for their basic necessities. However, if they have the nisab amount of wealth, regardless of whether it is a growing or non-growing asset, they are not considered poor or needy, and therefore not eligible to receive Zakaat (Ibnul Humam, Feth, II, 266). A debtor is a person who has a debt as an obligation, and does not have nisab amount of wealth other than the one that they will pay their debt with (Ibnul Humam, Feth, II, 268). A stranded person is someone who, although they may have money where they live permanently, is stranded without money and unable to reach their money while on a journey, and thus unable to return home. Such a person may be given enough Zakaat to cover their needs until they can return home and use their own money (Kasanizade, Bedai, II, 43-46). In modern times, if a traveler has the ability to withdraw their money from a bank account or use another means to access their money in their home country, then they are not eligible to receive Zakaat. The term "fisabilillah", meaning "in the cause of Allah", is interpreted as referring to pilgrims, soldiers fighting for Islam, and genuine scholars who are traveling for knowledge-seeking purposes.

According to the Hanafi school of thought, the following individuals are not eligible to receive Zakat and Fitra:

a) Parents, grandparents, great-grandparents,

b) Children, grandchildren, great-grandchildren, and their descendants,

c) Spouse,

d) Non-Muslims,

e) Wealthy individuals who have enough wealth to meet their basic needs and above the Nisab level,

f) Unmarried children whose fathers are wealthy (Marghinani, Al-Hidayah, II, 223-228).

The person who is obligated to pay zakat deducts the debts related to the rights of people from their wealth that is subject to zakat. According to the general view of the Hanafi school of thought, debts that are due or not due are subject to the same ruling in this matter. However, according to the view of some Hanafi scholars, only accumulated and requested debts that have reached their maturity date are deducted, and debts that have not yet matured are not deducted. Because such credit debts are generally not demanded by their creditors; only debts that have reached their maturity date are demanded (Kasani, Bedayi', II, 6). According to the famous view of the Shafi'i school of thought, however, no debt is deducted from any of the wealth subject to zakat, so indebtedness does not prevent giving zakat (Nawawi, Al-Majmu', V, 344). Currently, public, TOKI, cooperative, credit type debts with a long payment plan and will be paid regularly in the future should not be deducted entirely from zakat funds. Because these payment plans cover very long periods of 10-20 years, and people do not face the situation of paying these debts in that year. In this regard, only "accumulated debts for that zakat year, debts that have matured or will mature within that year, and therefore must be paid immediately during that zakat year" should be deducted from the wealth subject to zakat. Because zakat is an annual act of worship.

Those who possess 80.18 grams of gold or its equivalent in value in assets or cash, except for their annual debts and basic necessities, are considered wealthy according to Islamic law. If rental income, along with other assets and income, reaches the nisab amount (80.18 grams of gold or its value) after deducting basic necessities and debts, then zakat at a rate of one fortieth (2.5%) must be paid after one year has passed (Marghinani, al-Hidaya, II, 165, 190-191).

Personal ownership is fundamental in Islam. Therefore, even if a person lives with his father, if he possesses the nisab amount of zakat-eligible assets, he is obligated to pay zakat. However, if the person and his father have not separated their assets and share both earnings and expenses, then the person who has authority over their accumulated wealth is responsible for paying zakat.

The conditions regarding the obligation of zakat (alms-giving) and the validity of the given zakat are discussed under two separate headings. For zakat to be obligatory on a person, that person must be a Muslim, of sound mind, have reached the age of puberty, and be free (Kasani, Bedai', II, 4-5). Additionally, they must possess wealth in the form of an amount of property that is truly or potentially productive and capable of generating income, that is, the "nisab" amount, which is in excess of their debts and basic needs. Productivity refers to the income, profit, benefit, or natural growth and increase that the property provides to its owner. Furthermore, after one has obtained the nisab amount of property or assets, it must remain in their possession for a full lunar year, and at the end of that year, it must still meet the nisab threshold (Kasani, Bedai', II, 13 et seq.; Ibn Qudama, Al-Mughni, IV, 73-74). Fluctuations in value over the course of the year are not taken into account. Zakat can also be given before this period of time has passed (Kasani, Bedai', II, 15). Regarding the conditions for the validity of zakat, firstly, it is necessary to have the intention to give zakat. Since zakat is an act of worship, it cannot be performed without intention (Kasani, Bedai', II, 40; Ibn Qudama, Al-Mughni, IV, 88). Additionally, it is necessary to give the zakat to the poor and actually deliver it to them, which is called "temlik" (Kasani, Bedai', II, 39). It is not considered giving zakat to the poor by means of "ibaha," such as preparing food and feeding them.

Zakat was made obligatory in Medina in the second year after the Hijra. Zakat is mentioned in many verses of the Quran alongside prayer (Salat) (Al-Baqarah 2/43, 110; Al-Hajj 22/78; An-Nur 24/56). Prophet Muhammad (peace be upon him) also emphasized that Zakat is one of the fundamental pillars of Islam (Bukhari, Zakat, 1). The fact that prayer and zakat are mentioned together in the Quran and hadiths is very important in showing the role of these two acts of worship in achieving spiritual maturity for individuals and societies. The Quran states that giving Zakat is one of the most important conditions for achieving goodness and becoming a righteous believer (Al-Baqarah 2/177). Furthermore, giving Zakat is one of the qualities of a believer who will attain salvation (Al-Muminun 23/1, 4). In addition to all of these, giving Zakat is one of the acts that attract Allah's mercy (Al-A'raf 7/156). In short, Zakat is an act of worship that purifies wealth and facilitates spiritual purification (At-Tawbah 9/103). Refusal to give Zakat is considered a characteristic of pagans and is condemned in the Quran (Fussilat 41/6-7). Zakat has many benefits for society. For example, it contributes to meeting the needs of those who do not have financial means, reduces the gap between rich and poor, and helps create love and closeness between them. In this sense, Zakat increases social cohesion. Additionally, Zakat purifies societies from moral diseases such as selfishness and malice. The fact that the places where Zakat is given cover people from all segments of society is a guarantee of social solidarity.

The places where zakat is to be given are specified in the Quran (9:60). Prophet Muhammad (peace be upon him) said to a person who asked for his share of the collected zakat, "Allah did not leave the ruling on the distribution of zakat to the judgment of any prophet or anyone else. He Himself made the ruling and divided it into eight categories. If you belong to any of those categories, I will give you your due share." (Abu Dawud, Zakat, 24). Therefore, according to the majority of Islamic scholars, zakat and fitrah should not be given to any place other than the locations designated by Allah in the Quran, such as schools, Quranic courses, mosques, and similar charitable organizations. This is because one of the conditions for zakat and fitrah to be valid is that the ownership of the goods must be transferred. Transferring the ownership of goods means transferring the right of ownership or a proprietary right on the property to someone else. Therefore, it is not permissible to give zakat and fitrah, which belong to poor and needy Muslims and are the responsibility of those who own them, to legal entities or charitable organizations (al-Fatawa al-Hindiyya, I, 207). The phrase "in the way of Allah" (fi sabilillah) in the relevant verse is interpreted to mean the real people who have dedicated themselves to Allah's path and Islam, such as pilgrims, soldiers, and those who embark on journeys for knowledge.

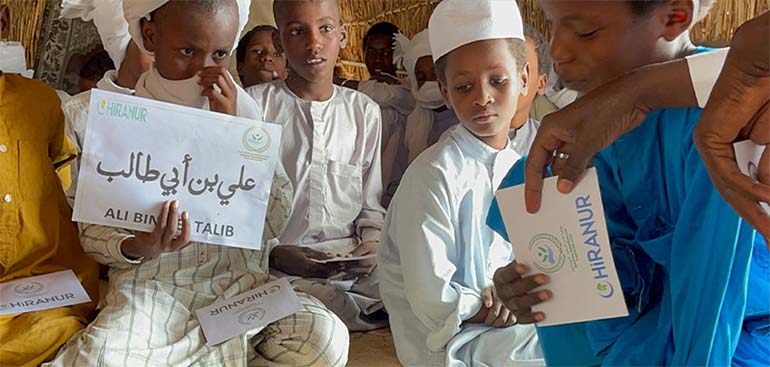

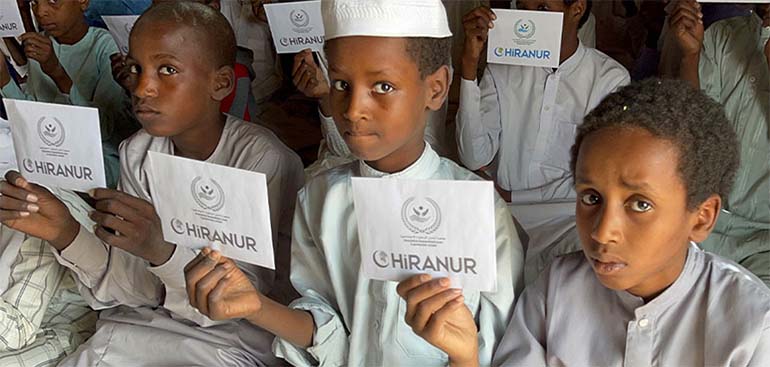

Through our volunteer field team located both domestically and internationally, we deliver your zakat donations to the needy individuals determined by us in advance. In this way, we are able to meet the needs of our oppressed brothers and sisters to some extent. Within the scope of our Zakat project, which is driven by a sense of brotherhood and solidarity, we have delivered your zakat to students of knowledge, scholars, and those in need, and we continue to do so.

Click on the Buttons to Support Our Projects